how to calculate nj taxable wages

Also check your W-2 to confirm that New Jersey or NJ appears in the State box. This calculator can determine overtime wages as well as calculate the total earnings for tipped employees.

Nj Temporary Disability Insurance Rates For 2022 Shelterpoint

All new employers except successors are assigned new employer rates for the first three calendar years after which a calculated rate is assigned based on employment experience.

. Several factors - like your marital status salary and additional tax withholdings - play a role in how much is taken. 2020 Tax Rate Increase for income between 1 million and 5 million. So if you earn 10 an hour enter 10 into the salary input and select Hourly Optional Select an alternate state the New Jersey Salary Calculator uses New Jersey as default selecting an alternate state will use the tax tables from that state.

In this case you are required to pay the commuter tax of 034. New Jerseys credit will be the lower of what New Jersey taxes the double-taxed income or what New York taxes the double-taxed income. For example unemployment compensation may be taxed by another jurisdiction but it is not taxable by New Jersey so you cannot.

Taxable pensions include all state and local government teachers and federal pensions as well as employee pensions and annuities from the private sector and Keogh plans. Just enter the wages tax withholdings and other information required below and our tool will take care of the rest. Because of these and other differences you must take the amount of wages from the State wages box on your W-2s Box 16.

After a few seconds you will be provided with a full breakdown of the tax you are paying. Calculate hourly employees wages by multiplying the number of hours worked by their pay rate including a higher rate for any overtime hours worked. Top Contribution Rates Supplemental Workforce Fund.

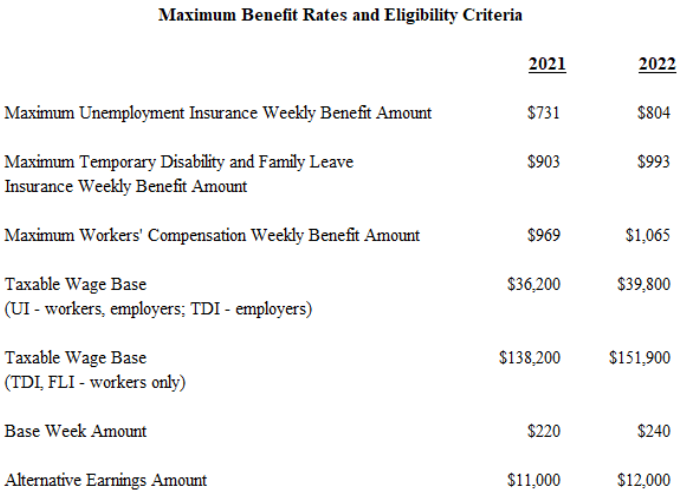

Discover Helpful Information And Resources On Taxes From AARP. Amounts received as early retirement benefits and amounts reported as pension on Schedule NJK-1 Partnership Return Form NJ-1065 are also taxable. The taxable wage base changes each year and is 28 times the statewide average weekly wage paid to workers subject to the law.

Taxable Retirement Income. How Your New Jersey Paycheck Works. Your employer uses the information that you provided on your W-4 form to determine how much to withhold in federal income tax each pay period.

If you estimate that you will owe more than 400 in New Jersey Income Tax at the end of the year you are required to make estimated payments. The Commissioner of Labor and Workforce Development determines this statewide average wage on or before September 1 of each year. The State Wages figure on your W-2 s from employment outside New Jersey may need to be adjusted to reflect New Jersey tax law.

Here is the formula for calculating taxable wages. Below is an explanation of how rates are calculated and a listing of the new employer rates for the current and the previous four years. Charitable Donations Charitable donations can be a bit complicated but if you are a New Jersey resident who works in New York you may be at an advantage when it.

The New Jersey income tax calculator is designed to provide a salary example with salary deductions made in New. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. How we calculate rates Base weeks.

This income tax calculator can help estimate your average income tax rate and your take home pay. Also make sure that when you are in the New Jersey return you have reviewed the screen About this W2 income. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

We dont make judgments or prescribe specific policies. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. New Jersey paycheck calculator Payroll Tax Salary Paycheck Calculator New Jersey Paycheck Calculator Use ADPs New Jersey Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Bonuses tips and commissions also get included in gross wages. Gross wages - Non-taxable wages - Pre-tax deductions Taxable benefits Taxable wages The best payroll software tools that calculate. How to Calculate Withhold and Pay New Jersey Income Tax Withholding Rate Tables Instructions for the Employers Reports Forms NJ-927 and.

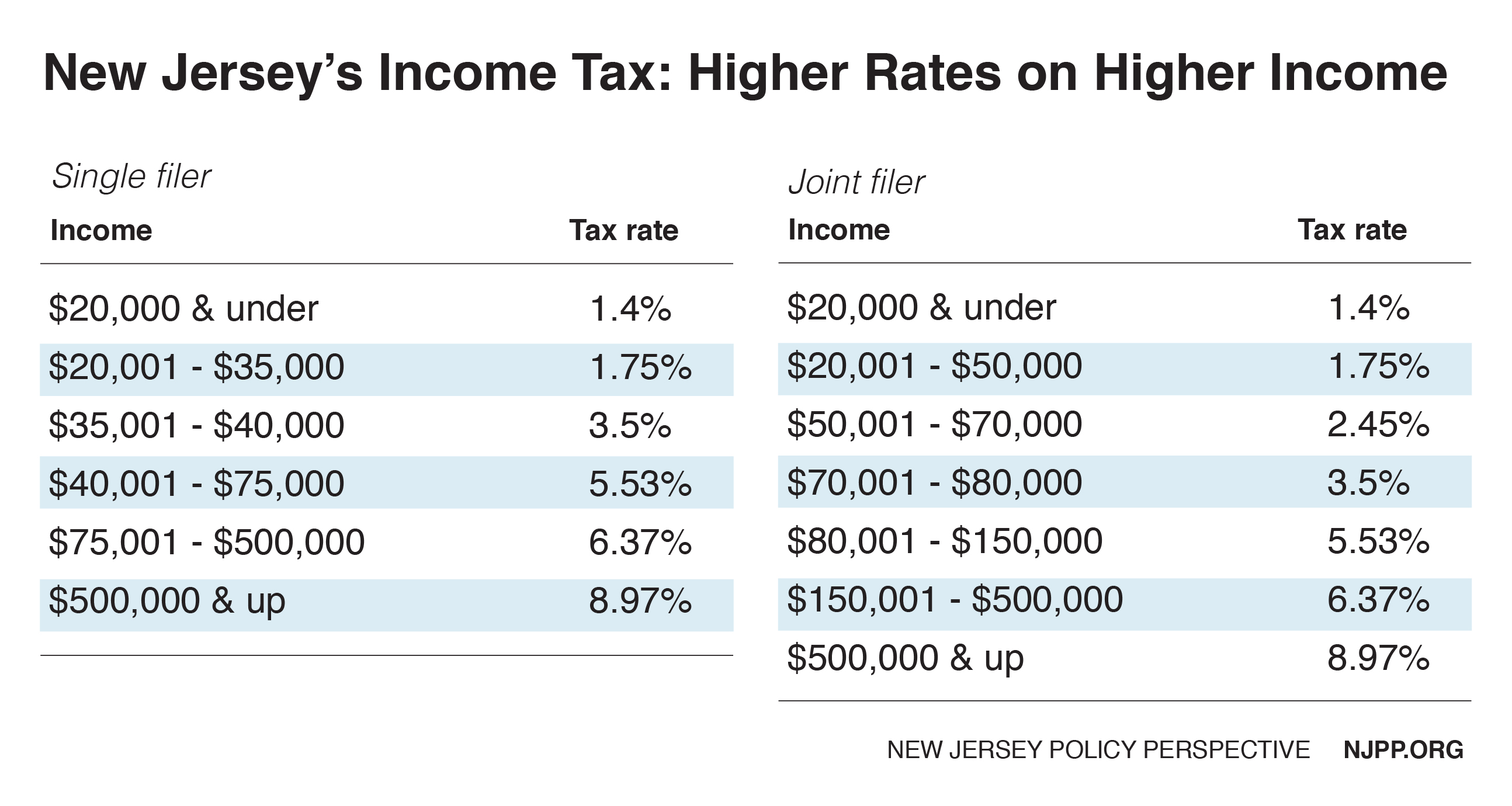

You will need to take into account the new rate when calculating your January 2021 payment. 00 hours 725. The state income tax rate in New Jersey is progressive and ranges from 14 to 1075 while federal income tax rates range from 10 to 37 depending on your income.

Income Actually Taxed by Both NJ and Another Jurisdiction Income Taxable in Another Jurisdiction Exempt From Tax in NJ Income must be taxed by bothNew Jersey and the other jurisdiction to be included on Schedule NJ-COJ. This prorate is New Yorks tax on the double-taxed income. The New Jersey tax calculator is updated for the 202223 tax year.

See what makes us different. Enter your salary or wages then choose the frequency at which you are paid. Calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income understand your tax liability Taxable income Tax rate Tax liability minus any additional tax withholdings Total annual income Tax liability All deductions Withholdings Your annual paycheck State payroll tax.

Federal income taxes are also withheld from each of your paychecks. O You can exclude from New Jersey Gross Income Tax the same pay that is excluded for federal income tax purposes using the federal definitions of combat zone pay. The NJ Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint and head of household filing in NJS.

To use our New Jersey Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. You can use this calculator to determine your pre-tax earnings at an hourly wage-earning job in New Jersey. Calculate salaried employees paychecks by dividing their salary by the number of pay periods per year.

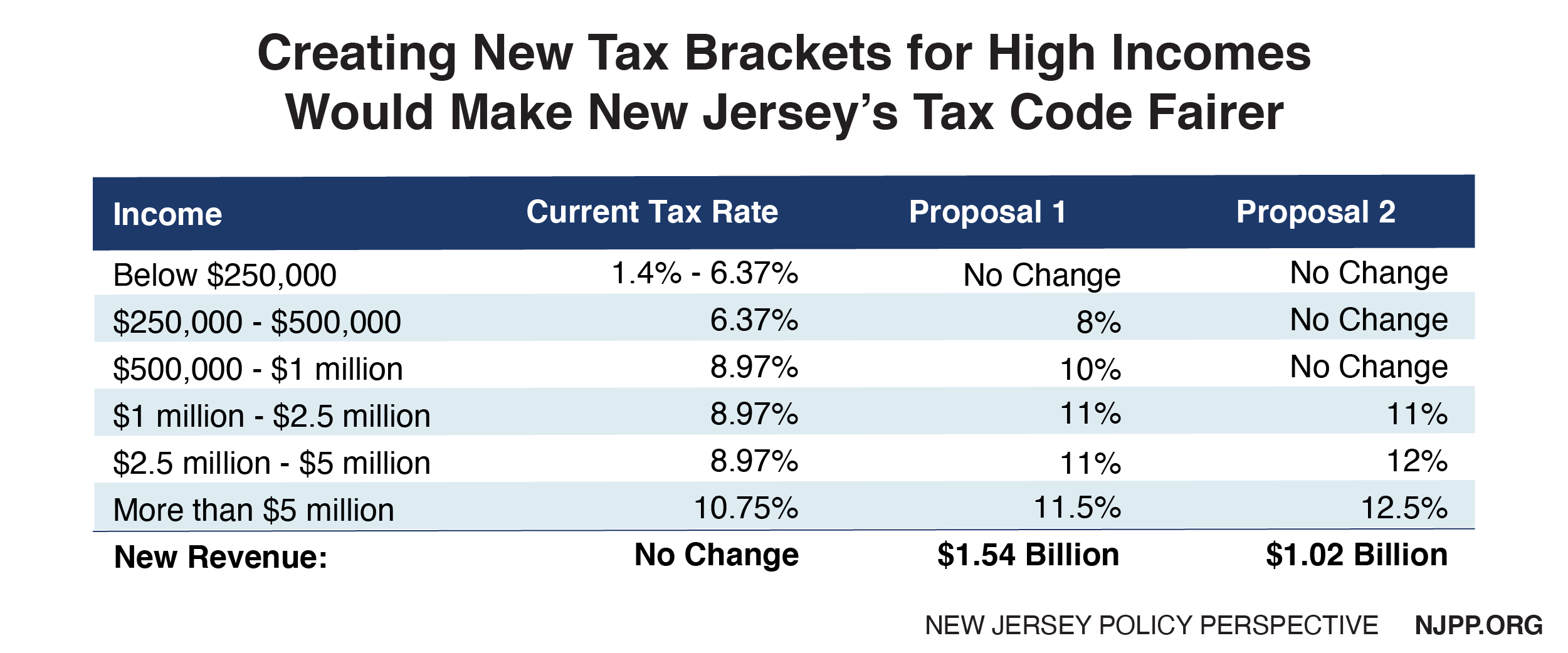

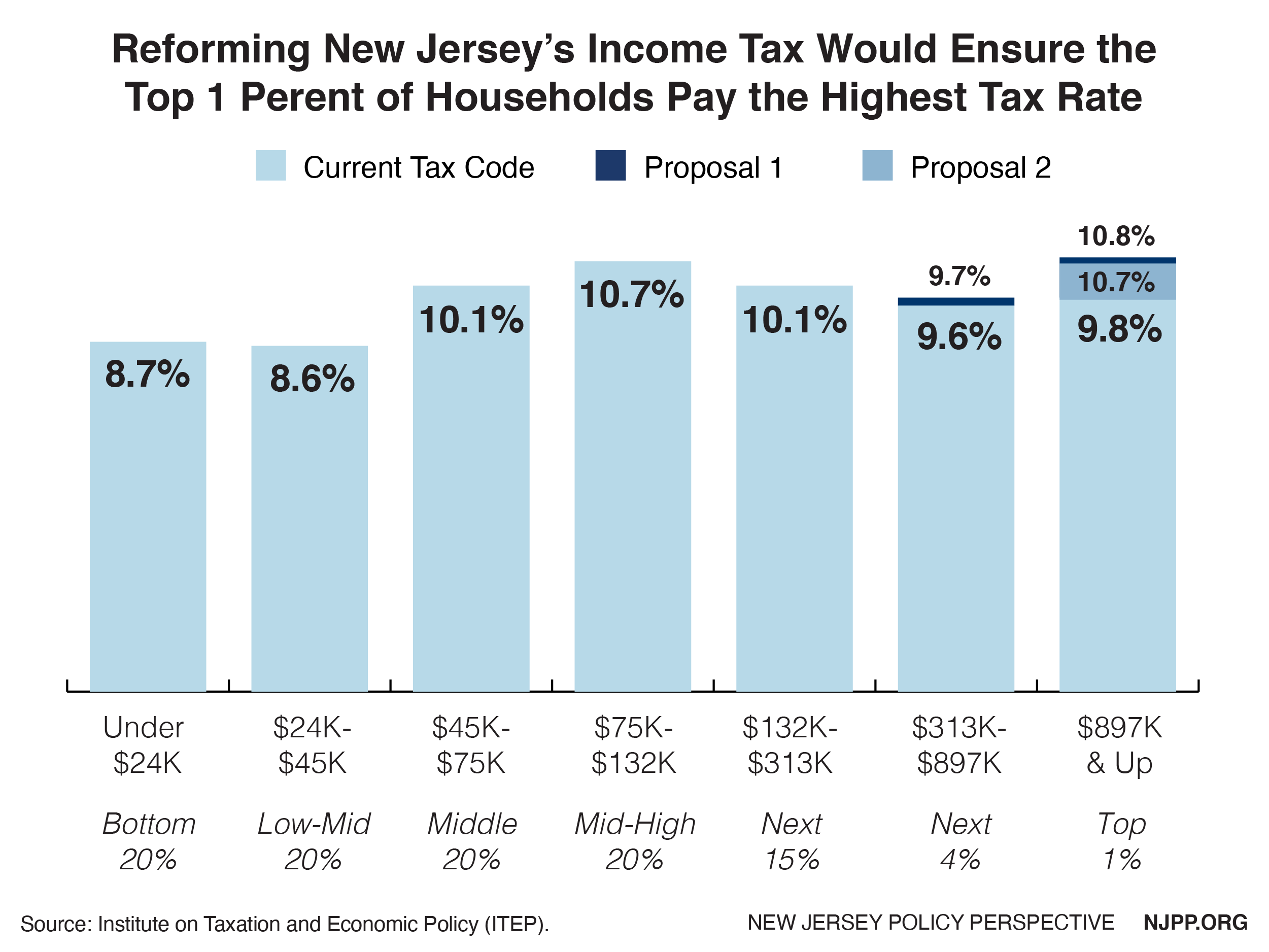

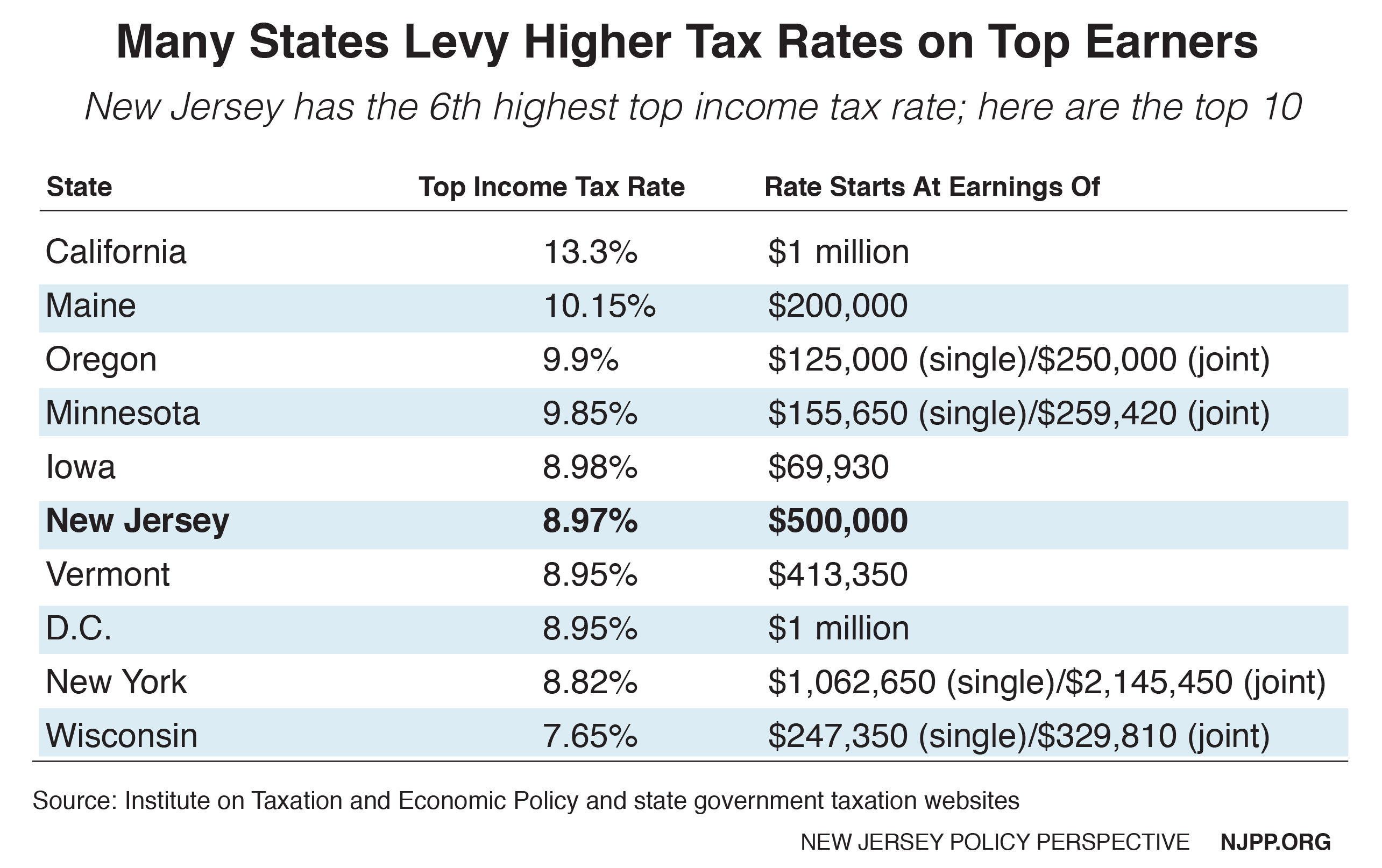

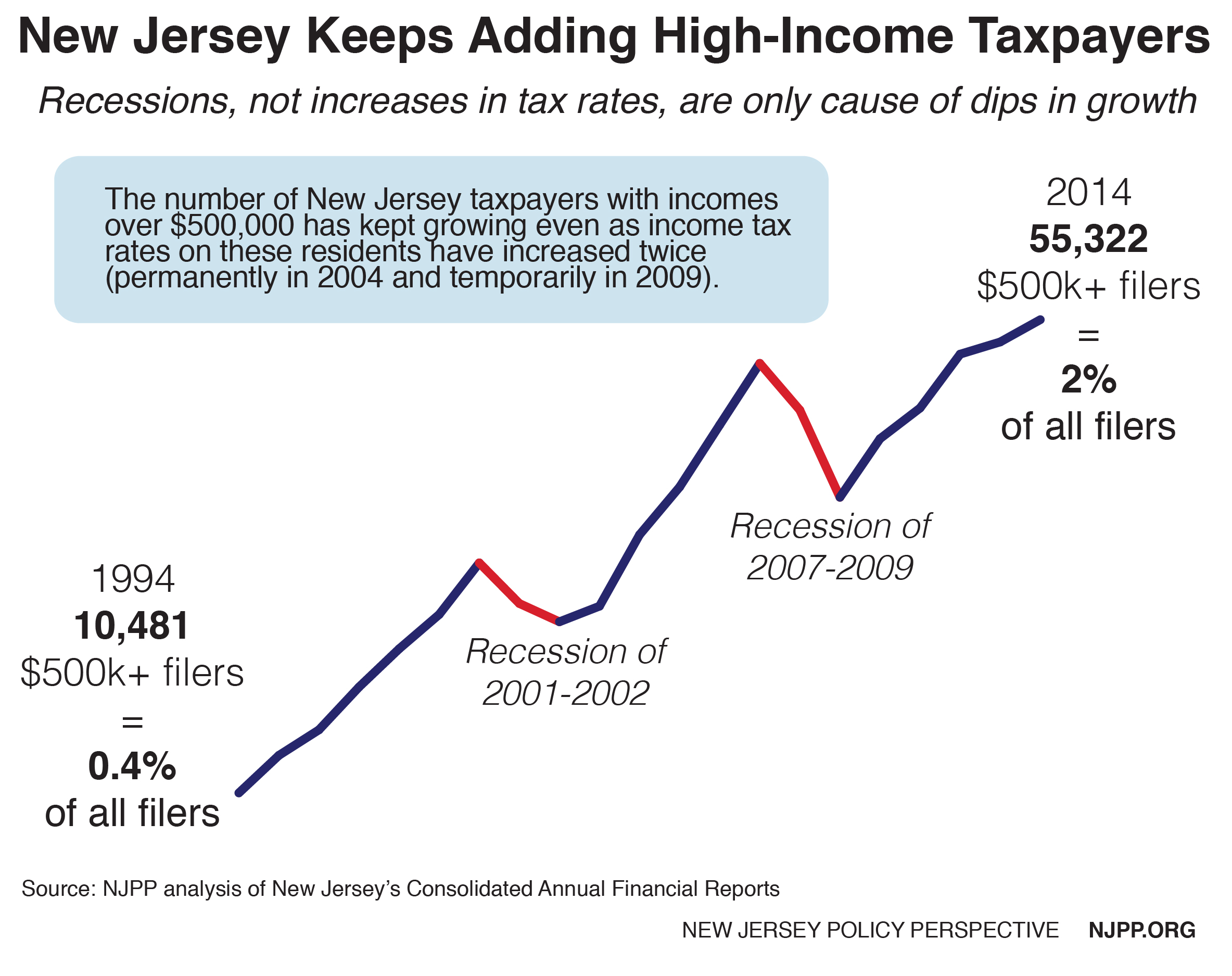

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

New Jersey Nj Tax Rate H R Block

New Jersey State Taxes 2021 Income And Sales Tax Rates Bankrate

Aatrix Nj Wage And Tax Formats

2022 Federal Payroll Tax Rates Abacus Payroll

Aatrix Nj Wage And Tax Formats

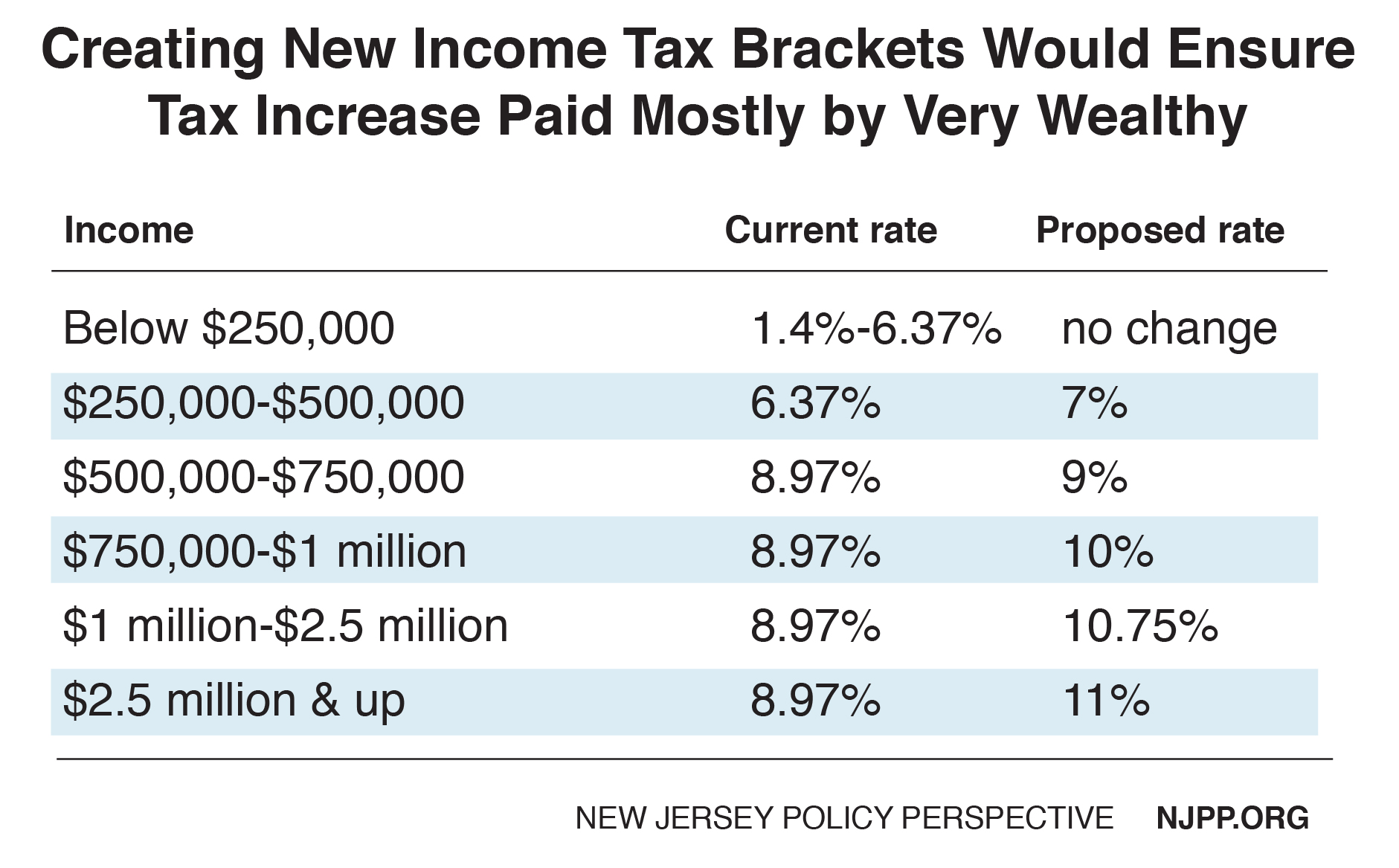

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

![]()

New Jersey Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Aatrix Nj Wage And Tax Formats

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Department Of Labor And Workforce Development Nj Department Of Labor And Workforce Development Announces Benefit Rate Increases For 2022

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

2021 New Jersey Payroll Tax Rates Abacus Payroll

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Nj Takes Another Look At Tax Bracketing Nj Spotlight News

Free New Jersey Payroll Calculator 2022 Nj Tax Rates Onpay

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective